Each of these columns is then added up at the end of the journaling period to arrive at a total sum. Chartered accountant Michael Brown is the founder and CEO cash payment journal adalah of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

Format Jurnal Pengeluaran Kas

The key information in this journal is the name of accounts, Accounting Reference, debit amount, and credit amount. Accounting number and accounting reference is also the importance and should be included. Debit and credit for both cash accounts and its correspondence accounts should also include. A cash disbursement will record any cash transfer, not just that of physical cash. This includes checks and electronic funds transfers or any other cash equivalent. Given that the basic posting procedures are the same as those for the other journals, the actual postings are not shown in the exhibit.

- Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

- When recording cash collections from customers it is quite common for the cash receipt journal to include a discounts allowed column.

- Normally most cash payments are to suppliers for credit purchases and the subsidiary ledger updated is the accounts payable ledger.

- The use of the journal saves time, avoids cluttering the general ledger with detail, and allows for segregation of duties.

Great! The Financial Professional Will Get Back To You Soon.

It is a critical tool in the success of any business as well as making sure all information provided to the Internal Revenue Service (IRS) is correct at tax time. It is important to understand that if any cash is paid, even if it relates only to a part of a larger transaction, then the entire transaction is entered into the cash disbursements journal. All the totals, except those in the other columns, are posted to the appropriate general ledger accounts. Especially when there are large cash payments transactions that occur in the business every day.

Cash Receipts Journal Totals Used to Update the General Ledger

But some businesses record other important details, such as discounts on bulk items purchased. Varying types of expenses may either be listed in different columns or they may receive distinct codes. The following example illustrates how a cash receipts journal is written and how entries from there are posted to relevant subsidiary and general ledger accounts. This special journal is created when the entity makes the accounting records using an accounting manual, and many cash payments transactions occur. The entries in the cash payment journal are recorded and posted in a similar manner to those in the cash receipts journal. Thus, the entries are entered sequentially into the cash payment journal as they occur.

As can be seen in the above example, 550 is posted to the ledger account of customer A and 350 to customer C. When posting to the accounts receivable ledger, a reference to the relevant page of the receipts journal would be included. The cash disbursement journal contains a variety of columns to record the cash outflows of the business.

For recording all cash outflows, another journal known as the cash disbursements journal or cash payments journal is used. The information recorded in the cash disbursement journal is used to make postings to the subsidiary ledgers and to relevant accounts in the general ledger. The cash disbursements journal is a book of prime entry and the entries in the journal are not part of the double entry posting.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible.

Records these transactions separately from the general journal help the entity reduce large amounts of transactions from the general journal. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. In this case, we expected that the company already record the account payable to the supplier for purchasing the company car amount USD 50,000. For example, the company makes payments to workers on the workers’ wages amounts to USD500,000 in cash.

On a monthly basis, these journals are reconciled with general ledger accounts, which are then used to create financial statements for regular accounting periods. In this case the debit entry is to the accounts payable control account in the general ledger, and represents the reduction in the amount outstanding to suppliers. Had the cash disbursement journal recorded other items such cash purchases etc. then the debit would have gone to the appropriate purchases or expense account. The information recorded in the cash receipt journal is used to make postings to the subsidiary ledgers and to relevant accounts in the general ledger.

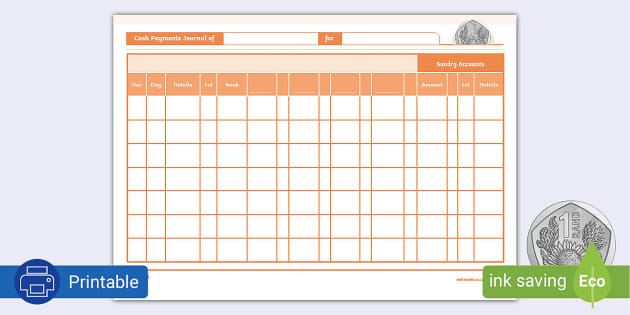

The journal can then be used to generate reports on spending and to track outgoing cash flow. It is important to understand that if any cash is received, even if it relates only to a part of a larger transaction, then the entire transaction is entered into the cash receipts journal. Besides the above payments, refunds of cash arising from the return of goods by customers are also recorded in the cash disbursements journal. The journal has a Date column, a Check Number column, a Payee column, and at least two credit columns, one for cash and one for purchase discounts. Regardless of the type of company, a business owner needs to use a cash disbursement journal any time cash is disbursed to keep a record of where money is being spent.